Commercial Mortgage-Backed Securities (CMBS) loans have been playing an increasingly important role in commercial real estate financing and account for around 30% of commercial loan originations. Because of the increasing use of CMBS loans, it is important for consultants to understand the different risk tolerances of the players in a CMBS transaction and how environmental due diligence may differ for CMBS transactions.

When retained to perform a phase 1 for a CMBS loan, consultants tailor their recommendations to the lender’s scope of work since the lender is the consultant’s client. However, in CMBS transactions, there is another big elephant in the room that Both the originating lender and the consultant need to satisfy– the so-called B piece buyers Recommendations that might make sense if a client was a sophisticated property owner or a portfolio lender might not be acceptable to a B-piece investor.

CMBS loans are securities created from the cash flows of pooled commercial mortgage that are usually secured by hotels, office buildings, shopping malls, and warehouses. In CMBS transactions, individual loans are originated by a lender (the consultant’s client). After closing on the loan, the originating lender will hold the loan on its books for a short period of time until it has accumulated a sufficient volume of loans and then sell the loans to a CMBS trust which is known as a real estate mortgage investment conduit (REMIC). The loans are sold pursuant to a pooling and servicing agreement (PSA) where the originating lender makes certain representations and warranties about the due diligence it performed for each loan including environmental due diligence.

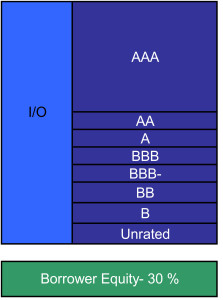

The CMBS trust pools or bundles the loans and then issues bonds that are secured by the cash flow from the mortgages. Rating agencies assign credit ratings to the various classes of bonds (which are known as tranches) ranging from investment grade (e.g., AAA/Aaa to BBB+) to below investment grade (BB+/ Ba1 through B-/B3). Sometimes the CMBS trust will also have unrated bonds. Loan payments are distributed to the holders of the lower-risk, lower-interest securities first, and then to the holders of the higher-risk securities. Here is illustration of the CMBS tranches.

After the loans are sold, the trust is administered by Master Servicer will is responsible for servicing all of the loans in the trust, including collecting monthly payments, verifying compliance, and waiving or modifying any mortgage conditions. If an individual loan goes into default, it will be assigned to a Special Servicer.

The critical player in any CMBS transaction are the investors who buy the below investment grade tranches who are called the B-piece buyers. Since holders of class A notes are paid interest and principal payments before the holders of the lower-grade notes, B-note investors will suffer losses before the investment-grade tranches.

Traditionally, B-piece buyers were specialist investors/funds but new players chasing yield have entered this and may now include private equity and public companies. B-piece buyers or a related entity also often serve as special servicer so that they can control the disposition of non-performing assets.

During the credit bubble, B-piece buyers often piggybacked on the environmental diligence performed by the CMBS issuer. Now, though, the due diligence performed by B-piece investors has dramatically increased. B-piece buyers are carefully reviewing properties proposed to be included in new CMBS pools and often force issuers to “kick-out” or drop troublesome properties from the pools. As a result, the B-piece buyers often drive underwriting standards and serve as a market watchdog. Indeed, it is not unusual for the B-piece buyers to perform desktop reviews or their own Phase I ESA reports. Moreover, environmental consultants and environmental attorneys retained by B-piece buyers are questioning conclusions in Phase I ESA reports and carefully vetting assumptions used to develop environmental loan reserves.

B-piece buyers tend to like cleanups or mitigation to be approved by regulatory agencies. For example, if a consultant identified a former UST that was removed in the past as an HREC but no closure documentation is available, the B-piece buyer might want further sampling investigation. Likewise, if the soil gas at a former shopping center is impacted by a former dry cleaner, a consultant might recommend that the property owner install a sub-slab depressurization system (SSDS) without involving the regulator since this could expand the scope of the investigation and increase the cost of the project. However, the B-piece buyer may insist that the SSDS to be approved by and installed under the supervision of a regulatory agency to keep the property in the CMBS pool.

An indemnity from a credit-worthy entity or environmental insurance can assuage the concerns of B-piece buyers. Fortunately, the environmental insurance market has become very competitive and coverage is not only widely available for unknown conditions but also at attractive pricing. Often times, it may be preferable to obtain a lender policy rather than collect samples from a former dry cleaner space. Borrowers with significant real estate holdings may have their own environmental pollution legal liability (PLL) policies and may want to have the lender added to the existing policy. However, there are often challenges fitting PLL policies into the particular needs of CMBS transactions so this option may be available.